Snapshot

▼ Sony Bank is gearing up to launch a U.S. dollar–pegged stablecoin as early as fiscal 2026.

▼ They’re setting up a U.S. branch and teaming up with local issuer Bastion.

▼ The stablecoin is mainly built for U.S. users who consume Sony’s games, anime, and digital content.

Sony Bank is quietly preparing something big. According to reports, they want to roll out a U.S. dollar–backed stablecoin in America as early as 2026. And they’re not doing it halfway they’ve already applied for a U.S. banking license and are working on creating a full U.S.-based unit just to handle this new digital money play.

They’ve also partnered with Bastion, a U.S. stablecoin issuer, so they can leverage Bastion’s infrastructure and actually bring this product to life.Sony’s vision is simple but powerful, let U.S. customers pay for games, anime, subscriptions, and everything inside the Sony universe using a stablecoin instead of credit cards.

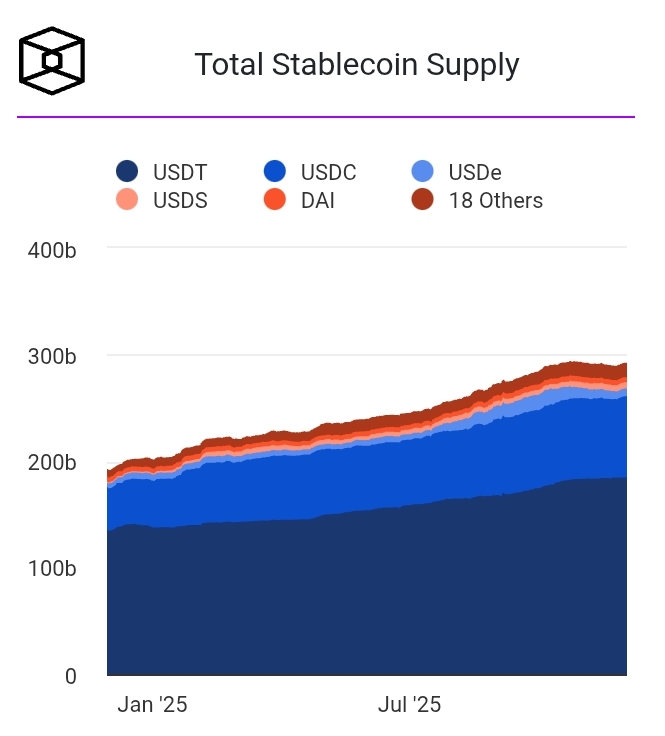

That means smoother payments, fewer fees, and a more seamless digital experience for millions of people who already live inside Sony’s ecosystem. And realistically It makes sense. The U.S. is Sony’s biggest market — over 30% of its external sales come from there. Pair that with a stablecoin market already above $291 billion and Sony sees an opportunity too big to ignore.

This move also connects with what Sony has already been building. Earlier this year, their Sony Block Solutions Labs launched Soneium, an Ethereum Layer 2 network designed to become the home for creators, fans, and entire digital communities.

Meanwhile back in Japan, the push for a yen stablecoin is also heating up. Regulators have approved JPYC to issue the country’s first yen-pegged stablecoin, and even three major banks are now teaming up on a joint stablecoin project.

In short, Sony isn’t just experimenting — they’re stepping fully into the future of digital payments. And honestly, the timing couldn’t be more perfect.