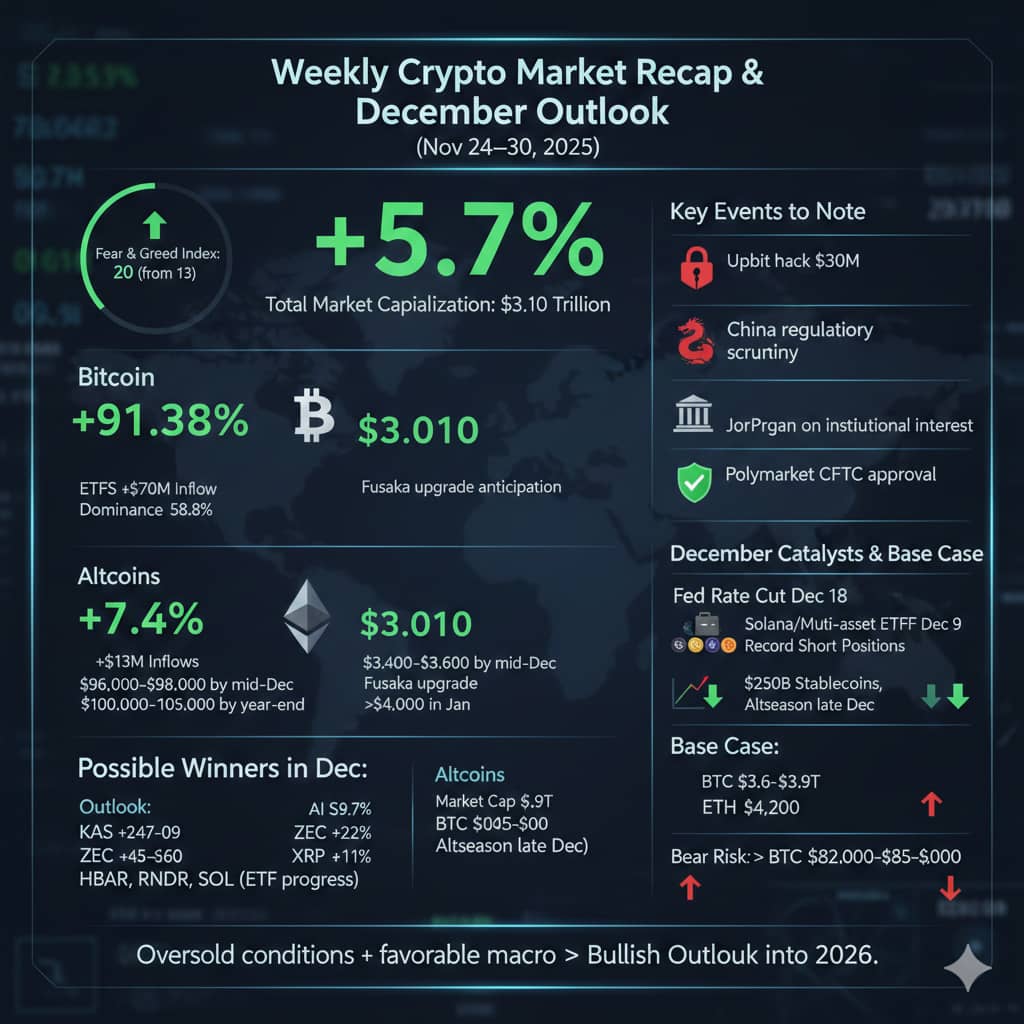

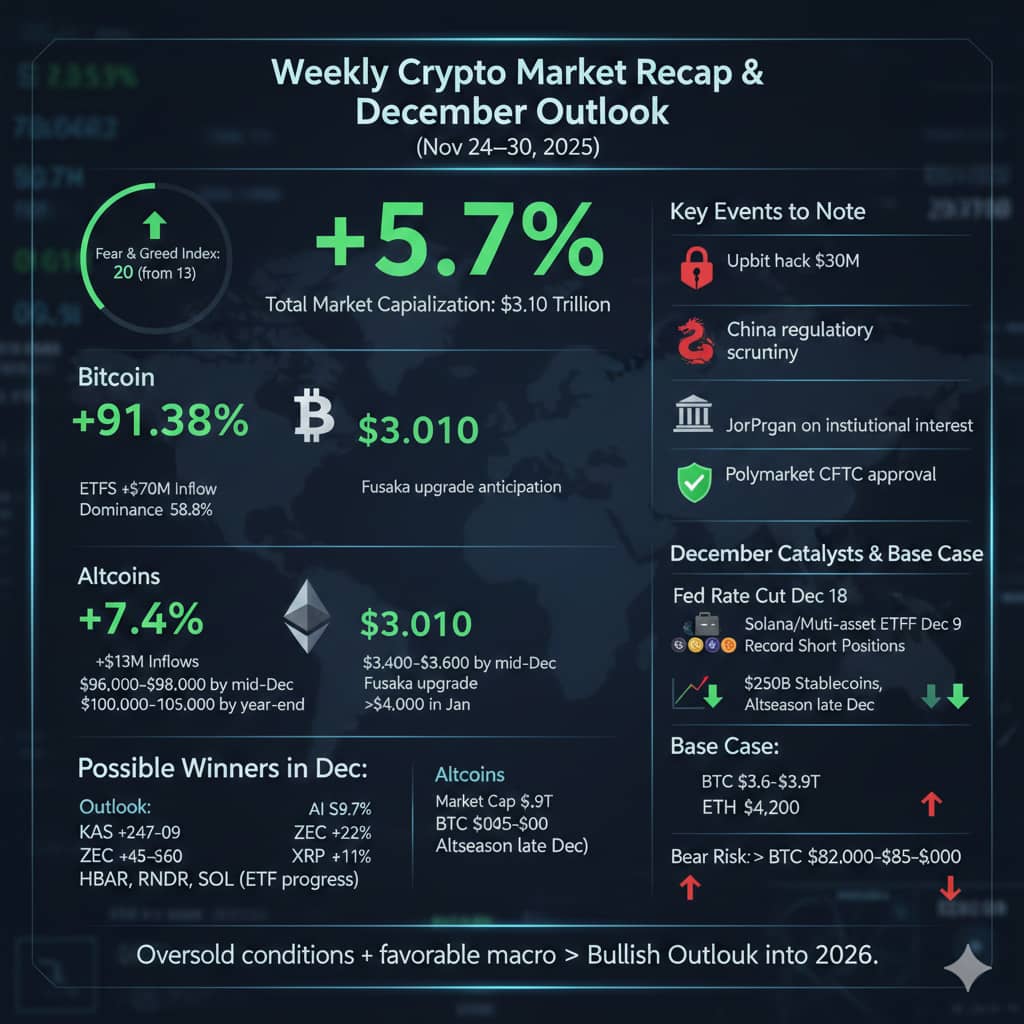

Weekly Crypto Market Recap & December Outlook (Nov 24–30, 2025)

This week, the crypto market experienced a significant recovery rising by 5.7% to reach a total market capitalization of $3.10 trillion, effectively reversing a large portion of last week’s losses.Market anxiety lessened considerably as liquidations fell to $820 million and the Fear & Greed Index improved from 13 to 20, indicating that the most intense phase of market capitulation may be over.

Bitcoin — +6.1% $91,382 Bitcoin saw its first weekly inflow from ETFs since October, attracting $70 million, while monthly outflows slowed to $3.79 billion. With a market dominance of 58.8%, confidence among institutional investors is tentatively returning.

➺ Outlook: As markets anticipate an 85% chance of a Federal Reserve rate cut in December and strong support materializing around $88,000–$90,000, Bitcoin is set to test the $96,000–$98,000 range by mid-December.There’s also potential for it to exceed $100,000–$105,000 before the end of the year, especially if ETF inflows increase following the Fed’s decision.

Ethereum has seen a significant increase of 7.4% reaching a price of $3,010 this week. The cryptocurrency benefited from $313 million in inflows to ETFs fueled by rising anticipation for the upcoming Fusaka upgrade.

➺ Market Outlook: The ETH/BTC pair appears to be establishing a cycle bottom. A retest of the $3,400 to $3,600 range is anticipated by mid-December and if post-upgrade gas demand rises alongside an adjustment in staking yields we could see prices exceeding $4,000 in January.

In terms of altcoins, notable gainers included KAS (+24%), ZEC (+22%), XRP (+11%), and the overall AI sector, which rose by 19.7%.

➺ Looking ahead: A shift in market focus toward AI, privacy coins, and Layer-1 platforms is expected as we approach the end of the year. Possible winners in December include:

⪼ KAS projected to reach $0.07–$0.09

⪼ ZEC expected between $45–$60

⪼ HBAR, RNDR, and SOL, particularly if there is progress with ETF applications.

➺ Key Events to Note

⪼ Upbit experienced a $30 million hack.

⪼ There is renewed regulatory scrutiny from China.

⪼ JPMorgan provided commentary on institutional interest in Bitcoin.

⪼ Polymarket received approval from the CFTC.

⪼ The U.S. Senate plans a vote on a market-structure bill in mid-December.

➺ December Catalysts & Base CaseThe Federal Reserve’s interest rate cut anticipated on December 18 could be a significant catalyst for increased market activity.

There is potential for Solana and multi-asset ETF applications during the week of December 9.Currently, there is $250 billion sitting in stablecoins and a record level of short positions in the market.

➺ Base Case: We expect the market capitalization to reach between $3.6 trillion and $3.9 trillion by December 31, with Bitcoin targeting $104,000, Ethereum aiming for $4,200 and the altcoin season likely to start in the last two weeks of the month.

➺ Bear Risk: If the DXY index rises above 108, it could force Bitcoin down to the $82,000–$85,000 range.

In summary, the combination of oversold market conditions and favorable macroeconomic factors strongly supports a bullish outlook as we head into 2026.